Pork industry economist sets strong tone in predictions for the pork industry

Date posted: January 13, 2022

Brett Stuart has been at Banff Pork Seminar (BPS) before. When you get invited back as a speaker, it usually means people got value out of what was said.

Stuart did not sit on the fence when he spoke to BPS 2022. The U.S. based economist with Global AgriTrends, a firm popular on both sides of the Canada-U.S. border, told delegates his job description is pretty simple: Keep ahead of global markets. Not always easy, he acknowledged and there hasn't been a year like last year in recent memory.

BPS delegates would be well advised to screen Stuart's presentation if they missed it the first time around. If you need encouraging here are a few highlights edited for brevity.

- We have completed the world's largest macro-economic experiment. Governments and economies around the world have poured enormous amounts of money into markets. That has fueled a global commodity super-cycle.

- This will last a lot longer than people think. Stuart predicts a soft landing. And he says the party doesn't end until the money runs out. There is a huge amount of money sitting on the sideline. More than 65 percent of this money is in the accounts of the wealthy. This is a huge impact on consumers. Inflation is a tax on the poor.

- Who can afford to pay for corn? Hog producers are least equipped. Be careful.

- The FED has set a much more aggressive tone but interest rate increases will be small and not likely to be a big factor. Inflation will look like it's over but we will just live with the new pricing. It took 18 percent interest to break the last major inflation cycle.

- Inflation will run hot. Could turn to stagflation, where economy slows.

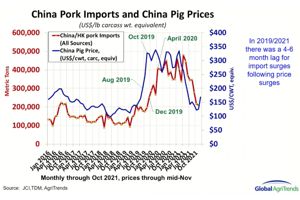

- China is a key global market driver. African Swine Fever is a major challenge. China will be a major corn importer going forward. In 2021 pork prices in China fell 70 percent. That slow bleed will continue so the roller coaster could take off again. The Chinese mega farm model may not work. African Swine Fever is not the only disease.

- African Swine Fever is not just a European problem. What if it hits the U.S.? Export markets would close instantly and the U.S. has 25 percent more pork than they need. This is a very dire problem. And it's worse for Canada. Hope it doesn't happen.

Thoughts on global risk

Several points.

Labor issue and risks. There could be more strikes ahead as labor unions leverage their position. Packers that a year ago were at $14 an hour are now at $21 and $24. Politicians want a high minimum wage which impacts their stance on foreign workers. Get used to it. Labor problems will not be fixed this year.

California Prop 12. This is an animal welfare requirement put on all suppliers. Could see California have less pork than it needs and rest of the country more than it needs. Not sure they will enforce or when.

Fertilizer frenzy. Global shortage is driving fertilizer to record prices. Half of the world crop production progress exists because of fertilizer. It allows us to feed people. The fertilizer issue is not over so figure out how to work with the situation.

Greenhouse gas emissions. The new war on emissions is on methane, so livestock, petroleum and landfills will be targets. Good news is this is not as scary as we may have thought for livestock production. New research and information is emerging that will show the livestock footprint is much lower than originally thought.

Russian troops on Ukraine border. Ukraine is a big corn and wheat exporter. Not sure where this ends but it will likely not end well.

Ten year pork outlook. If past correlation of pork and meat production with GDP output then the world will need record supplies to handle growth. Ask yourself as a pork producer how do I grow when demand is chasing supply? The challenge will be market access in a world hungry for meat protein in the next 10 years.

Plant-based and lab meats. Growth will not continue at the current pace for plant based meats. Watch lab based meats. Technology tends to improve over time. So, and get more economical for example, so could be day when lab based meats are blended with regular.